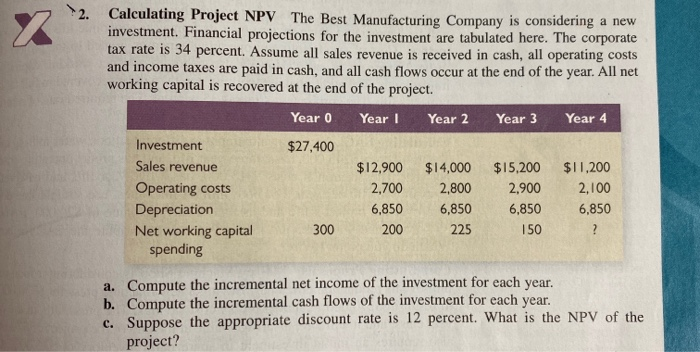

To measure the longer-term monetary and fiscal profit margins of any option contract companies can use the capital-budgeting process. Thus driving consistent growth and increasing margin over time.

Incrementality And Measuring Marketing Efforts Yellowhead

Kamblog Incremental Sales To Cover Vat Increase

1

That means if you have your current sales of 75000 and new sales of 95000 your incremental sales will be a total of 20000 resulted in your marketing campaigns.

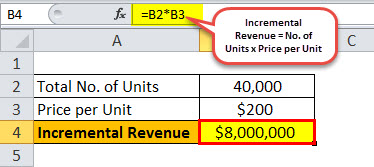

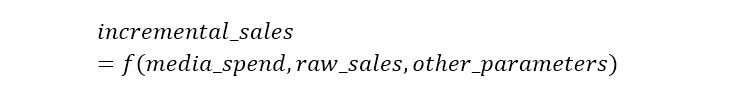

Incremental sales formula. The Sales Acceleration Formula Author. It can be used to determine the additional revenue generated by a certain product investment or direct sale from a marketing campaign when the quantity of sales has grown. Disruption is a change to the market that is so powerful and different that it requires others in the field to follow suit or be left behind.

Conclusion Incremental Revenue helps the management to analyze and arrive at a decision whether or not to. Positive incremental cash flow is a. It can be discouraging to see slow incremental revenue increases when you want to be showing investors exponential growth.

Discount 100-Discount x 360Allowed payment days Discount days For example a supplier of Franklin Drilling offers the company 215 net 40 payment terms. Scale is about adding revenue at a rapid rate while adding resources at an incremental rate. Written as a formula the percent change is.

Marginal Cost Marginal Cost Formula The marginal cost formula represents the incremental costs incurred when producing additional units of a good or service. The denominator of the formula becomes incremental cash flow if an old asset eg machine or equipment etc is replaced by a new one. The result is expressed as a percentage.

Model and formula The classical supply. 5 Advantages and 6 Disadvantages Read. In the case of an individual it can be calculated by taking a ratio of total tax expenses and taxable income and for corporations it is calculated by dividing total income tax expense by the earnings before taxes.

Incremental revenue is a deciding factor in terms of sales volumes and marketing campaigns that are required to be made for the business to earn profits. Youll learn a science-based approach to asking questions securing incremental commitments resolving objections reducing your competitions influence and more. The last calculation using the mathematical equation is the same as the breakeven sales formula using the fixed costs and the contribution margin ratio previously discussed in this chapter.

The carrying cost formula in action. It helps in the decision of whether to invest in a project or which project among available ones would maximize the returns. In other words with incremental budgeting the amounts of the current budget are used as a base to which incremental assumptions are either added.

Incremental budgeting is a form of the budgeting process based on the concept that a new budget can be prepared by making only some marginal changes to the current years budget. This happens because firms with high degree of operating leverage DOL do not increase costs proportionally to their sales. Small modular change that takes place slowly over time and allows for a gradual development of the product and its marketplace.

Compared to other methods like Net present value Net Present Value Net Present Value NPV estimates the profitability of a project and is the difference between the present value of cash inflows and the present value of cash outflows over the projects. The formula for the cost of credit is as follows. Machine X would cost 25000 and would have a useful life of 10 years with zero salvage value.

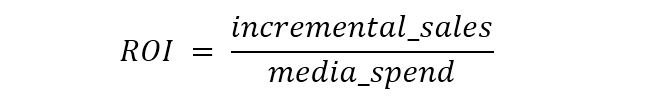

Perishable products present another twist. If a firm generates a high gross margin it also generates a high DOL ratio and can make more money from incremental revenues. Examples of Incremental Analysis.

Sales team training only works if its 100 relevant to the reps role tactical customized. The carrying cost formula can be used to calculate annual carrying costs quarterly carrying costs or a smaller increment of your choosing. They have mastered the formula of quickly adding customers while adding fewer additional resources.

Capital budgeting projects are accepted or rejected according to different valuation methods used by different businesses. D Trump footwear company earned total sales revenues of 25M for the second quarter of the current year. The sales have increased 593 over the fiveyear period while.

If the earliest year is zero or negative the percent. The management team can use estimates of sales direct costs and fixed costs to forecast profit levels in future periods. However to cover for variable costs a firm needs to increase its sales.

Stock-outs cause incremental lost sales to reach the point where one extra stock-out causes the loss of the whole recurring client. Its best to do an annual inventory carrying cost calculation as well as an incremental calculation at an interval that coincides with your sales cycle. Variable costs per unit are constant.

The Delta company is planning to purchase a machine known as machine X. Sales price per unit is constant. The computation of direct labor cost involves certain factors like labor rate level of expertise our and number of hours employed for production.

The formula for total variable cost can be computed by using the following steps. Effective Tax Rate Formula In a very simple language the effective tax rate is the average rate of tax at which the income of a corporation or an individual is taxed. A common outcome of contribution analysis is an increased understanding of the number of units of product that must be sold in order to support an incremental increase in.

Incremental cash flow is the potential increase or decrease in a companys cash flow related to the acceptance of a new project or investment in a new asset. Formula for the Cost of Credit. Firstly determine the direct labor cost that can be directly apportioned to the production level.

The marginal cost Margin of Safety Margin of Safety Formula The margin of safety formula is equal to current sales minus the breakeven point divided by current sales. Find out why ASLAN is a leader in sales training programs. Incremental Analysis Examples of Incremental Analysis.

Incremental innovation is exactly as it sounds. 20X0 in this example times 100. The sales revenue formula helps you calculate revenue to optimize your price strategy plan expenses determine growth strategies and analyze trends.

The contribution margin helps to separate out the fixed cost and profit components coming from product sales and can be used to determine the selling price range of a product the profit levels. If the cost of credit is higher than the companys incremental cost of capital take the discount. For that period the cost of raw materials and supplies used for the sold products was 9M labor costs directly applied were 2M administrative and staff salaries totaled 4M and there were depreciation and amortizations of 1M.

If you track this sales KPI on a regular basis you will be able to determine which campaigns bring you the best possible results and develop further strategies with these new facts. If the stock cover that is to say the stock expressed in days rather than in unit of stock. Incremental revenue is the profit a business gains from an increase in sales.

Incremental Revenue Definition Formula Calculation With Examples

How To Calculate Incremental Sales Driven By Media Tactic

Solved Please Slove And Show One Example Of Sloving Chegg Com

Incrementality The Best Way To Measure Ad Success Retargeter

How To Calculate Incremental Sales Driven By Media Tactic

Incremental Revenue Definition Formula Calculation With Examples

Increased Profits Not Higher Revenues Determine Marketing Roi Business 2 Community

Learn Here The Incremental Sales Definition Best Practices To Follow