The excess between the selling price and total variable costs is known as contribution margin. Retailers use this key concept to understand how much units must be sold to meet the minimum costs and manufacturers use it to calculate the number of units that must be manufactured and sold during.

Using Break Even Analysis To Evaluate A Marketing Plan Video Lesson Transcript Study Com

Break Even Point Definition Formula And Methods To Calculate Bep

How Can I Calculate Break Even Analysis In Excel

It means that there were no net profits or no net losses for the company - it broke even.

Break even point formula. It is a comprehensive guide to help set targets in terms of units or revenue. For any new business this is an important calculation in your business planPotential investors in a business not only want to know. Confirm this figured by multiplying the break-even in units 500 by the sale price 100.

Profit earned following your break even. Determine the break-even point in sales by finding your contribution margin ratio. BEP may also refer to the revenues that are needed to be reached in order to compensate for the expenses incurred.

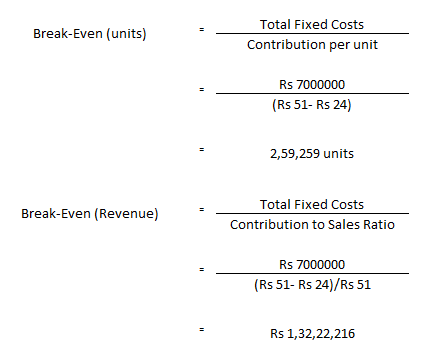

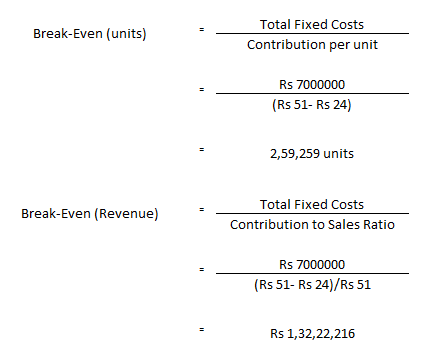

One can determine the break-even point in sales dollars instead of units by dividing the companys total fixed expenses by the contribution margin ratio. The break-even point gives you a clear picture of how much time will it take for your business to recover any losses and break even again after a change in the business forecast. Break-even point in rupees Contribution Margin.

Break-even Point In Sales Dollars. Break-even point BEP is a term in accounting that refers to the situation where a companys revenues and expenses were equal within a specific accounting period. How to use a break-even analysis.

Again heres the break-even point for sales dollars formula. All the different types of break-even analyses are based on the following basic equation. The contribution margin ratio is the contribution margin divided by sales revenuesThe ratio can be calculated using company totals or per unit amounts.

What is the Break Even Analysis Formula. Any sales beyond that point contribute to your net profit. Thus the break-even point is that level of operations at which a company realizes no net income or loss.

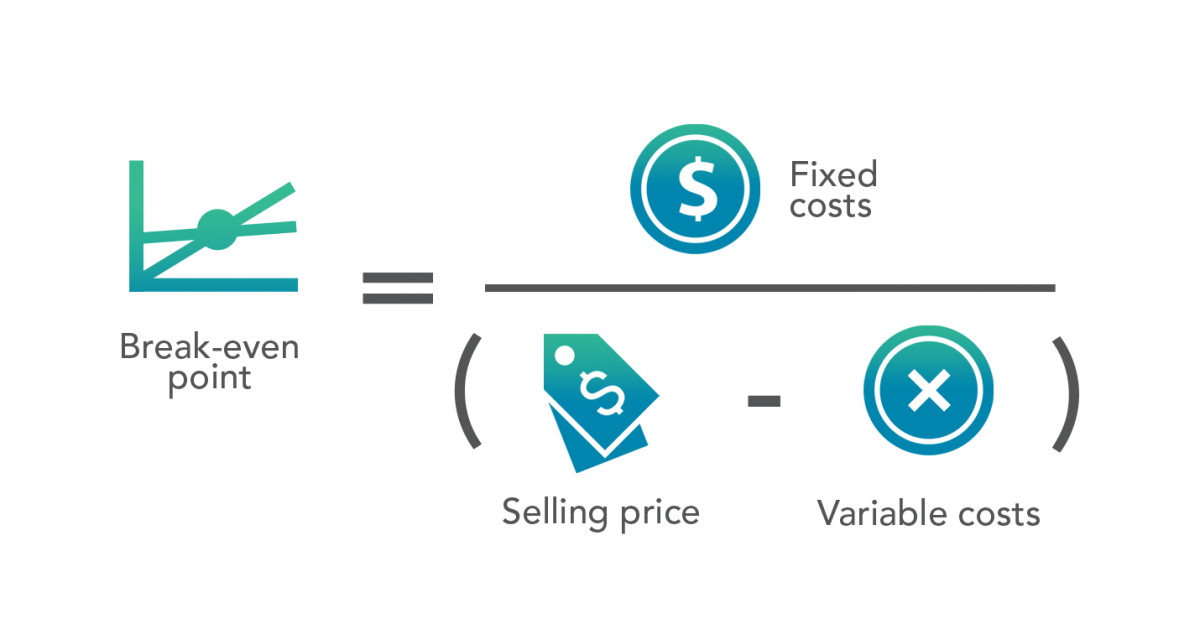

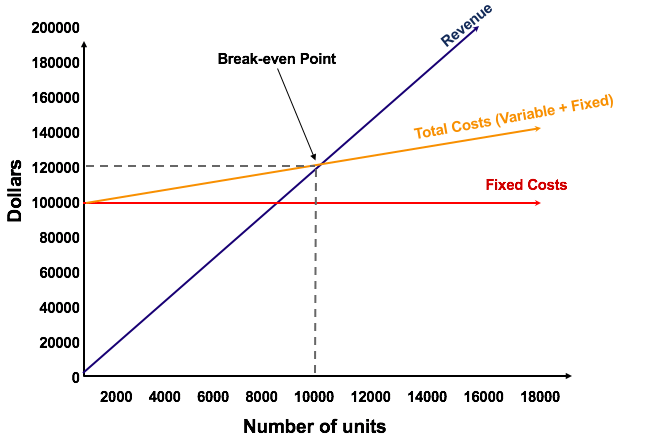

The formula for break-even point Break-even Point Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost ie the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company its fixed cost and the variable cost. The difference between the total expenses line and the total revenue line. A company breaks even for a given period when sales revenue and costs charged to that period are equal.

A break-even analysis allows you to determine your break-even point. The break-even point in units for Oil Change Co. Q F P V or Break Even Point Q Fixed Cost Unit Price Variable Unit Cost Where.

This means that Turner Corporation has to sell 63637 units per month to cover all of its expenses and reach the break-even point. The break-even point is the point where a companys revenues equals its costs. The calculation method for the break-even point of sales mix is based on the contribution approach method.

There is no net loss or gain and one has broken even though opportunity costs have been paid and capital has received the risk-adjusted expected return. Its always a good idea to check your calculations. The calculation for the break-even point can be done one of two ways.

In this article we look at 1 break-even analysis and how it works 2 application and benefits and 3 calculations. The break-even point BEP in economics businessand specifically cost accountingis the point at which total cost and total revenue are equal ie. Once your sales equal your fixed and variable costs you have reached the break-even point and the company will report a net profit or loss of 0.

Is the number of cars it needs to service in order to cover both the companys fixed and variable expenses. Therefore the break-even point in sales dollars is 50000 20000 total fixed costs divided by 40. 70000 200 - 090 63637 units.

Break-even analysis also deals with the contribution margin of a product. A Break-Even point is a point where the total cost of a product or service is equal to total revenueIt calculates the margin of safety by comparing the value of revenue with covered fixed and variable costs associated with sales. See reference 1 for more information about this model and especially the discussion about the assumptions.

Fixed Costs Sales. Q is the break even quantity F is the total fixed costs P is the selling price per unit V is the variable cost per unit. A company may express a break-even point in dollars of sales revenue or number of units produced or sold.

It provides companies with targets to cover costs and make a profit. Break-even point is considered a measurement tool that is used in cost accounting business and economics to determine the point when both the total cost and revenues are even. Break-even Point In Units.

It wont be able to pick up that nuance. One is to determine the amount of units that need to be sold or the second is the amount of sales in dollars that need to happen. Break Even Analysis Formula Table of Contents Formula.

Many businesses have multiple products with multiple prices. The break-even point in the above graph is 2000 units or 30000 that agrees with the break-even point computed using equation and contribution margin methods above. Calculating your break-even point.

The break-even point in dollars is the amount of income you need to bring in to reach your break-even point. There are a number of ways you can calculate your break-even point. With this information we can calculate the break-even point using our formula.

Finding the break-even point. The break-even point is the point at which total cost and total revenue are equal meaning there is no loss or gain for your small businessIn other words youve reached the level of production at which the costs of production equals the revenues for a product. Break-Even Price Effects There are both positive and negative effects of.

One simple formula uses your fixed costs and gross profit margin to determine your break-even point. Break-even point analysis is a measurement system that calculates the margin of safety by comparing the amount of revenues or units that must be sold to cover fixed and variable costs associated with making the sales. In short all costs that must be paid are paid and there is neither profit.

We get Break-Even Sales at 5000 units x Rs. Strategy Whether youre trying to promote your brand-new product stay ahead of your competitors or cut down on your expenses you need to have a strategy in place. Youll likely need to work with one product at a time or estimate an average price based on all the products you might sell.

Break Even Point Formula and Example. The formula used to calculate a breakeven point BEP is based on the linear Cost-Volume-Profit CVP Model 1 which is a practical tool for simplified calculations and short-term projections. Fixed costs exist regardless of how much you sell or dont sell and include expenses such as rent wages power phone accounts and insurance.

Break-even analysis one of the most popular business tools is used by companies to determine the level of profitability. Since we have multiple products in sales mix therefore it is most likely that we will be dealing with products with different contribution margin per unit and contribution margin ratios. In other words its a way to calculate when a project will be profitable by equating its total revenues with its total expenses.

The Break Even Calculator uses the following formulas. The break-even point formula is to divide the total amount of fixed costs by the contribution margin per car. The break-even point is equal to the total fixed costs divided by the difference between the unit price and variable costs.

The break-even point formula is simplistic.

Break Even Formula Double Entry Bookkeeping

Break Even Price Formula How To Calculate Break Even Price

Break Even Point Example Definition Investinganswers

Break Even Analysis Learn How To Calculate The Break Even Point

Break Even Point Analysis Formula Plan Projections

What Is Break Even Analysis Calculation Formula Examples

Break Even Analysis Template Formula To Calculate Break Even Point

Break Even Analysis Meaning Calculation And Benefits