Ireland is on all academic tax haven lists including the Leaders in tax haven research and tax NGOsIreland does not meet the 1998 OECD definition of a tax haven but no OECD member including Switzerland ever met this definition. Green Investment Tax Allowance GITA Projects.

The Green Investment Tax Allowance Gita Maqo

Only World Group Likely To Get Investment Tax Allowance The Edge Markets

Solargreentax Explore

Green Cost Tax Allowance for GBI certified buildings extended to 2020.

Green investment tax allowance. Its a great time to be a landlord. And renaming Free School Meals the School Meals Allowance to tackle stigma. The current cap on the Lifetime Allowance is 1.

ITA is an incentive granted based on the capital expenditure incurred on industrial buildings plant and machinery used for the purpose of the promoted activities or the production of the promoted products. Tax Incentive for Tax Allowance Project GBI certified projects are eligible for Investment Tax Allowance ITA of 100 of qualifying capital expenditure incurred on green cost from the year of assessment 2013 date on which the first qualifying capital expenditure incurred is not earlier than 25 October 2013 until the. Just over 400 UK doctors have unnecessarily paid over 11m in Lifetime Allowance LTA charges Quilter has revealed after making a Freedom of Information FOI request.

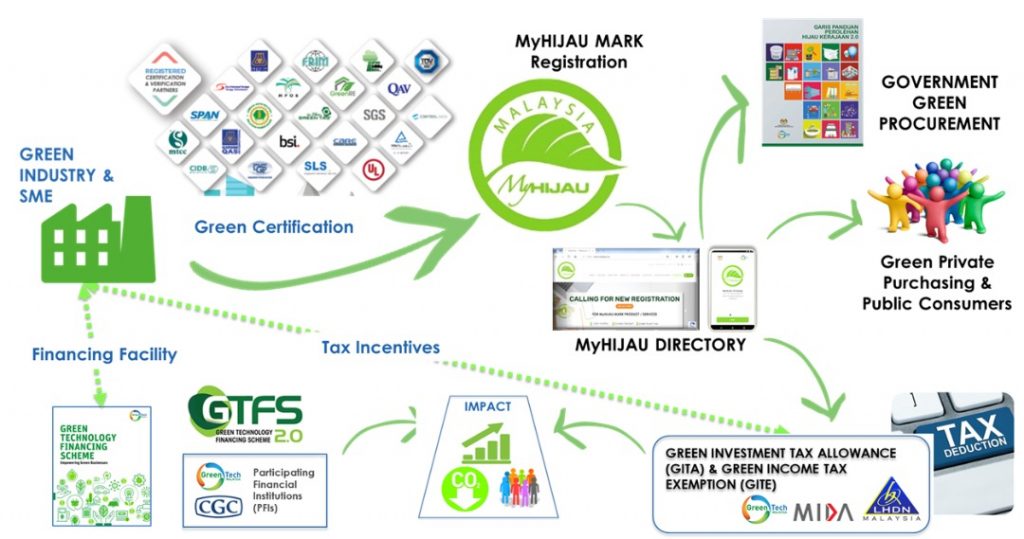

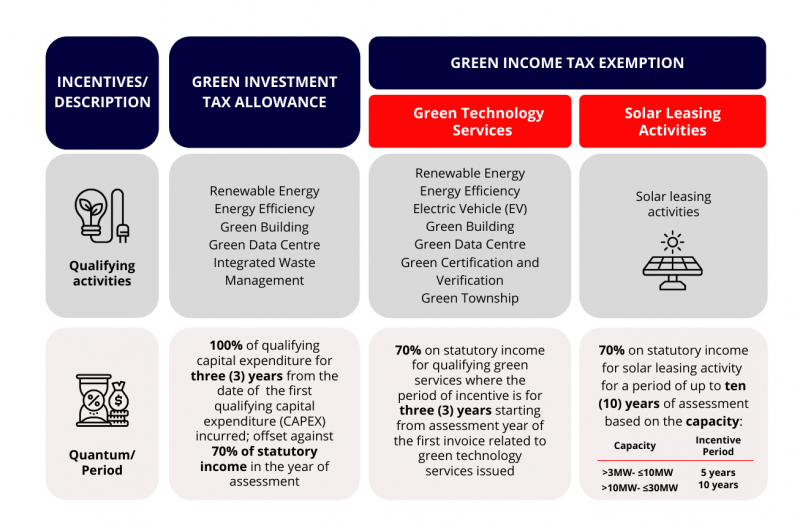

If you have opened several cash ISAs over the years you can transfer the funds into one single cash ISA youll keep the tax-free benefits and youll only have one account to manage. Up to a period of 5 years there will be a tax exemption on the statutory income earned from the business of pre-school or kindergarten. Applicable for qualifying green technology service provider companies that are listed under the MyHIJAU Directory.

The allowance can be offset against 70 of statutory income in the year of assessment. Green Income Tax Exemption GITE Services. This will be a combined investment of over 100 billion a year in the Green New Deal with an additional investment in Universal Basic Income.

The Green Deal is an integral part of this Commissions strategy to implement the United Nations 2030 Agenda and the sustainable development goals3 and the other priorities announced in President von der Leyens political guidelines4. Invest from 25 to 50000. If any green technology equipment has to be purchased an investment tax allowance can be claimed.

The alternative to pioneer status incentive is usually the investment tax allowance ITA. Renewable EnergyInvestment Tax Credit ITC The investment tax credit is allowed section 48 of the Internal Revenue Code. Green Investment Tax Allowance GITA of 100 of qualifying capital expenditure incurred on green technology project from the date of application received by MIDA until the year of assessment 2020.

Of the governments new National Savings and Investment NSI Green. Here the amount you can claim as LTA ie the money spent during the travel when on leave is equal to the. You can only pay into one cash ISA each tax year but you can also invest in a stocks and shares ISA andor an innovative finance ISA so long as you dont go over your 20000 allowance.

The Association of Convenience Stores ACS has welcomed the action by chancellor Rishi Sunak to support businesses through green investment incentives. For the building used as pre-school or kindergarten an IBA at 10 per annum will be given. Investment allowance of 60 of QCE incurred within five years to be utilised against 70 of statutory income or income tax exemption of 70 of statutory income for a period of five years.

While many expect Capital Gains Tax and Inheritance Tax to be prime targets warnings have emerged that green announcements could catch. Penn Wharton estimates that raising the top capital-gains tax rate to 434 would shrink federal revenue by 33 billion over 10 years. Applicable for companies that undertake qualifying green technology projects for business or own consumption.

Apply a Carbon Tax on all fossil fuel imports and domestic extraction. Capital Cost Allowance - CCA. The Tax Foundation finds it would shrink federal revenue by 124 billion over 10 years.

Quilter believed that a substantial number of doctors had missed out on applying for LTA protection and had paid more than necessary in tax. A fun way to save with the chance to win tax-free prizes each month. As part of the Green Deal the Commission will refocus the European Semester process of.

Annual investment allowance delayed. The tax-exmeption on HRA is available only if taxpayer opts for old tax regime. Only Trinidad Tobago met it in 2017.

In his budget speech to parliament today Sunak said green investments such as solar panels and. Ireland has been labelled a tax haven or corporate tax haven in multiple reports an allegation which the state rejects. Benefits are derived from tax credits in the year the property is placed in service cash flow over 6 years and repurchase options in year six.

Leave Travel Allowance forms a part of an employees total CTC cost-to-companyAlso known as Leave Travel Concession an employee can claim exemption under section 105 of the Income Tax Act 1961 for expenses incurred for travelling when on leave anywhere in the country. Trustnet News research More green gilts dividend tax and. An employee can avail tax benefit on HRA as per the rules laid out in the law provided heshe is paying rent and living on the rented accommodation.

Tax time bomb 2020 Landlord tax saving stategies. As part of Budget 2020 measures the Government continues to prioritise green adoption to spur economic multiplier effects by extending the Green Investment Tax Allowance for the purchase of green technology assets and Green Income Tax Exemption on the use of green technology services until 2023. Buildings used solely for the purposes of such projects qualify for an industrial building allowance.

100 annual prize fund rate. Although businesses will no longer be able to claim an ECA on new purchases of ETL equipment from April 2020 the Annual Investment Allowance AIA scheme is another form of accelerated tax relief. But unpopular legislation was already in place for the 100 annual investment allowance AIA threshold for spend on plant and machinery to fall on 1 January 2022 from 1m to 200000.

As an initiative to encourage the buying and selling of green technologies the Government provides an Investment Tax Allowance ITA for purchasing green technology equipment assets and an Income Tax Exemption ITE for providing green technology services. The left-leaning Tax Policy Center writes that Bidens proposal raises taxes far past the amount necessary to maximize. A capital cost allowance CCA is a yearly deduction or depreciation that can be claimed for income tax purposes on.

Many of us landlords including me are making record rental profits but this also means potentially a record tax bill for landlordsThis is because interest rates are still on the floor and latest projections indicate that they are likely to remain low for many years to come as national governments continue.

Igem 2020 Goes Virtual Join Us Live Mida Malaysian Investment Development Authority

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

The Green Investment Tax Allowance Gita Maqo

Green Investment Tax Incentives Gita Gite Malaysian Green Technology And Climate Change Corporation

Website Gita Assets Guidelines On Gita Assets Rate Of Incentive Green Investment Tax Allowance Gita Pdf Document

Green Investment Tax Incentives Gita Gite Malaysian Green Technology And Climate Change Corporation

Who We Are Myhijau

Green Technology Incentives Towards Achieving Sustainable Development In Malaysia Mida Malaysian Investment Development Authority